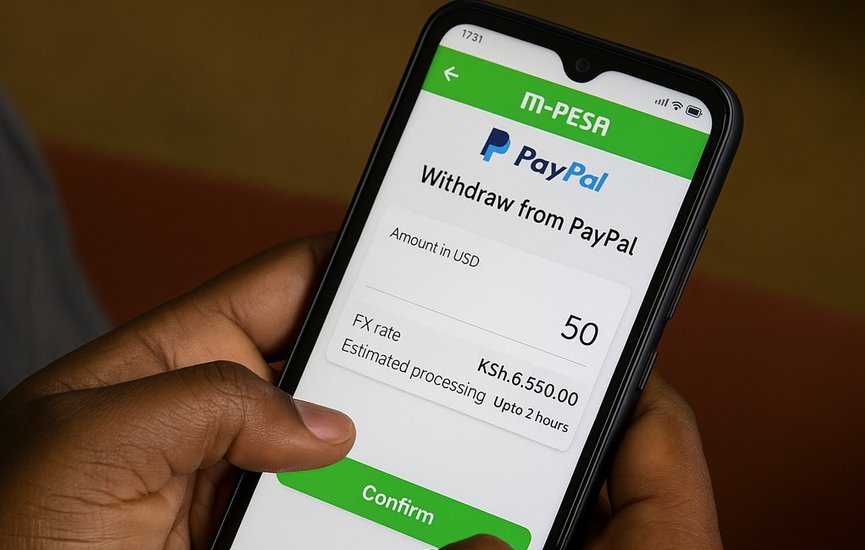

Cash Plus and PayPal have launched Morocco's first-ever digital PayPal withdrawal service, according to a joint announcement made on Monday. This new collaboration enables Moroccan PayPal users to instantly convert their PayPal balances into Moroccan dirhams via the Cash Plus Mobile app.

The service removes the need for physical branch visits, paperwork, or third-party intermediaries. Cash Plus is now the exclusive provider in Morocco offering digital PayPal withdrawals, creating a seamless solution for freelancers, entrepreneurs, creators, and e-commerce vendors in the country.

Otto Williams, Senior Vice President and Regional Head for the Middle East and Africa at PayPal, shared, "At PayPal, we believe financial services should be digital-first, accessible, inclusive, and tailored to how people live and work today."

He added that this partnership brings that vision to life in Morocco, providing "an all-in-one wallet experience that makes withdrawing PayPal earnings faster, simpler, and entirely branch-free."

The launch coincides with Morocco’s ongoing push to strengthen its digital economy, which now has over 18 million internet users. The country’s digital payments market is expected to grow from $14.29 billion in 2025 to more than $35 billion by 2030. This partnership also aligns with Morocco’s National Financial Inclusion Strategy, which seeks to integrate 75% of the adult population into the formal financial system by 2030. The service fills a key gap in the country’s digital workforce, offering instant access to global earnings without requiring a foreign bank account.

Nabil Amar, President of the Cash Plus Group, described the collaboration as “a significant milestone in our mission to democratize access to global financial services.”

“By enabling secure, instant withdrawals in MAD, we’re empowering Morocco’s digital generation with the speed, autonomy, and simplicity they expect— all within a single app,” Amar added.

The partnership also aligns with PayPal’s broader strategy to expand across the Middle East and Africa, forging localized partnerships that connect more people to the global digital economy.

Cash Plus, a licensed payment institution by Bank Al Maghrib, offers a range of financial and para-financial services. PayPal, operating in around 200 markets worldwide, has been a leader in creating innovative payment solutions for more than 25 years.